Did you know that non-compliance penalties for Australian businesses can reach millions of dollars? Beyond financial consequences, compliance failures can lead to operational disruptions, damaged stakeholder relationships, and in severe cases, criminal charges for directors and officers.

A well-structured compliance audit helps identify gaps in your processes and mitigate risks before they become costly problems. This comprehensive checklist will guide you through conducting an effective compliance audit for your Australian business.

Whether you’re preparing for your first audit or looking to enhance your existing compliance framework, this guide provides actionable insights to ensure your business operates within legal and regulatory requirements.

What Is a Compliance Audit and Why Does It Matter?

A compliance audit is a systematic examination of your organisation’s adherence to regulatory guidelines, internal policies, and industry standards. It serves as a health check for your business’s regulatory practices.

Unlike financial audits that focus on monetary aspects, compliance audits evaluate whether your business operations align with applicable laws and regulations. These audits can be conducted internally by your team or by external specialists.

For Australian businesses, compliance audits are crucial safeguards against legal penalties, reputational damage, and operational disruptions. They provide documented evidence that your organisation takes its regulatory responsibilities seriously.

How Do Compliance Audits Protect Australian Businesses?

1. Legal Protection

Non-compliance with Australian regulations can result in severe penalties, including hefty fines and potential legal action. Regular compliance audits help identify and address issues before they attract regulatory attention.

Many industry-specific regulations in Australia mandate regular compliance checks. For example, businesses handling personal data must comply with the Privacy Act 1988 and the Australian Privacy Principles (APPs), while those in financial services must adhere to ASIC regulations and anti-money laundering legislation.

2. Risk Management

Compliance audits function as early warning systems for potential risks. By identifying compliance gaps, your business can implement corrective measures before small issues escalate into major problems.

A thorough audit helps pinpoint areas where employees might need additional training or where processes require refinement. This proactive approach minimises operational risks and enhances overall business resilience.

3. Business Reputation

Australian consumers and business partners increasingly value ethical practices and regulatory compliance. A strong compliance record enhances your brand reputation and builds trust with stakeholders.

Many tender processes and business partnerships now require evidence of compliance with relevant Australian regulations. Regular audits provide documented proof of your commitment to meeting these standards.

What Areas Should Your Compliance Audit Cover?

Workplace Health and Safety Compliance

| WHS Audit Element | Key Considerations | Documentation Required |

|---|---|---|

| Risk assessments | Identification of workplace hazards | Completed risk assessment forms |

| Safety training | Staff competency and knowledge | Training records and certificates |

| Emergency procedures | Evacuation plans and drills | Emergency response documentation |

| Incident reporting | Process for recording incidents | Incident registers and reports |

| Equipment safety | Maintenance and inspection | Equipment logs and test results |

Workplace Health and Safety regulations under the Work Health and Safety Act 2011 are non-negotiable for Australian businesses. Your audit should verify that all steps reasonably practicable are taken to ensure a safe working environment.

Regular safety inspections, proper training documentation, and up-to-date incident reporting systems are essential components of WHS compliance. Check that your business maintains comprehensive records in these areas.

Employment and Fair Work Compliance

Verify that your employment contracts, pay rates, and workplace conditions comply with the Fair Work Act 2009. This includes checking award rates, enterprise agreements, and National Employment Standards.

Ensure your business maintains accurate records of employee entitlements, including leave accruals, superannuation contributions, and pay records. These documents must be retained for at least seven years under Australian record-keeping requirements.

Review your workplace policies regarding discrimination, harassment, and bullying to ensure they meet current legislative requirements and best practices for Australian workplaces.

Privacy and Data Protection

Assess how your business collects, stores, uses, and discloses personal information. Ensure your practices align with the Australian Privacy Principles under the Privacy Act 1988.

Review your privacy policy to confirm it clearly communicates how customer and employee data is managed. The policy should be easily accessible, written in plain language, and comply with the Notifiable Data Breaches scheme requirements.

Verify that appropriate security measures are in place to protect sensitive data. This includes both technical safeguards and staff training on data handling procedures.

Financial and Taxation Compliance

Confirm your business maintains accurate financial records and lodges tax returns and business activity statements on time. Proper record-keeping is essential for ATO compliance.

Check that your business correctly classifies workers (employees vs contractors) and meets superannuation obligations. Misclassification can result in significant penalties under the Superannuation Guarantee (Administration) Act 1992.

Verify compliance with industry-specific financial regulations, such as those in financial services, insurance, or credit industries if applicable to your business.

How Should You Prepare for a Compliance Audit Step-by-Step?

1. Create a Compliance Calendar

Develop a calendar marking key compliance deadlines throughout the year. This should include lodgement dates for tax returns, license renewals, and mandatory reporting requirements.

A well-maintained compliance calendar helps prevent missed deadlines and ensures your business allocates sufficient resources to meet regulatory obligations in a timely manner.

2. Assemble Your Audit Team

Identify key personnel responsible for different compliance areas within your organisation. This might include HR managers, safety officers, financial controllers, and department heads.

Consider whether you need external expertise for certain aspects of the audit. Specialised consultants can provide valuable insights in complex regulatory areas.

3. Gather Required Documentation

Essential Documents Checklist:

- Company registration documents

- Business licenses and permits

- Employment contracts and policies

- WHS procedures and incident reports

- Financial records and tax documentation

- Privacy policies and data management protocols

- Training records and competency assessments

- Insurance certificates and coverage details

Organise these documents in a structured manner before beginning the audit. Digital document management systems can significantly streamline this process, providing secure storage and easy retrieval during your audit.

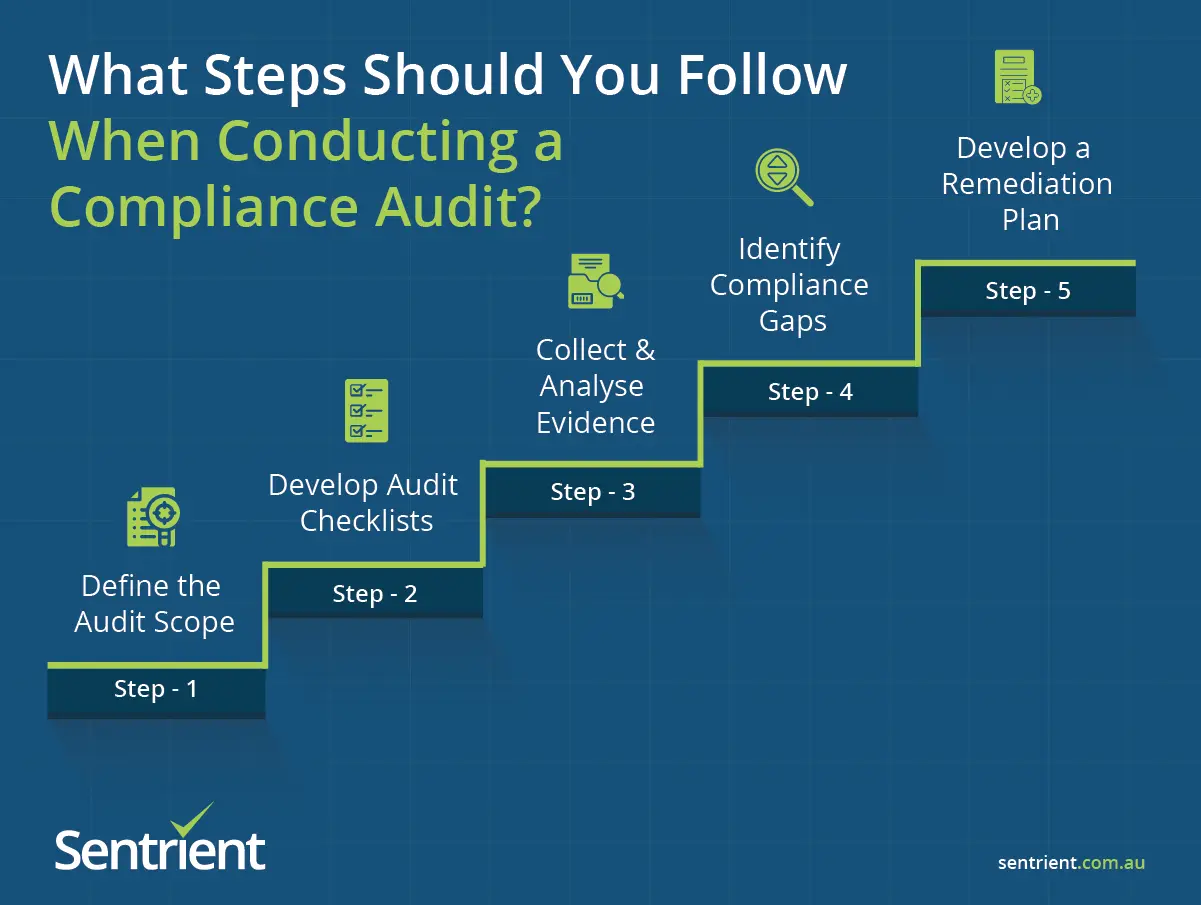

What Steps Should You Follow When Conducting a Compliance Audit?

Step 1: Define the Audit Scope

Clearly outline which regulations, policies, and procedures will be examined. The scope may vary depending on your industry, business size, and specific compliance requirements.

Determine whether the audit will cover the entire organisation or focus on specific departments or processes. A well-defined scope prevents the audit from becoming unmanageable.

Step 2: Develop Audit Checklists

Create detailed checklists for each compliance area based on current regulations and industry standards. These should include specific questions to assess compliance status.

Tailored checklists ensure consistency in the audit process and help prevent important compliance aspects from being overlooked during the evaluation.

Step 3: Collect and Analyse Evidence

Gather documentation, conduct interviews, and observe workplace practices to collect evidence of compliance or non-compliance with regulatory requirements.

Document your findings systematically, noting both areas of strong compliance and potential gaps. Use a standardised format to ensure consistent assessment across different areas.

Step 4: Identify Compliance Gaps

Compare your findings against regulatory requirements to identify any areas where your business falls short of compliance standards.

Prioritise gaps based on their potential impact and the likelihood of regulatory action. This helps allocate resources effectively during the remediation phase.

Step 5: Develop a Remediation Plan

| Priority Level | Response Timeframe | Resource Allocation |

|---|---|---|

| Critical | Immediate action (1-7 days) | High priority resources |

| High | Short-term (8-30 days) | Significant resource allocation |

| Medium | Medium-term (1-3 months) | Moderate resource allocation |

| Low | Long-term (3-6 months) | Limited resource allocation |

Create a detailed plan to address identified compliance gaps. Include specific actions, responsible parties, and realistic timeframes for implementation.

Ensure the remediation plan includes both immediate fixes for critical issues and longer-term strategies to prevent recurrence of compliance problems.

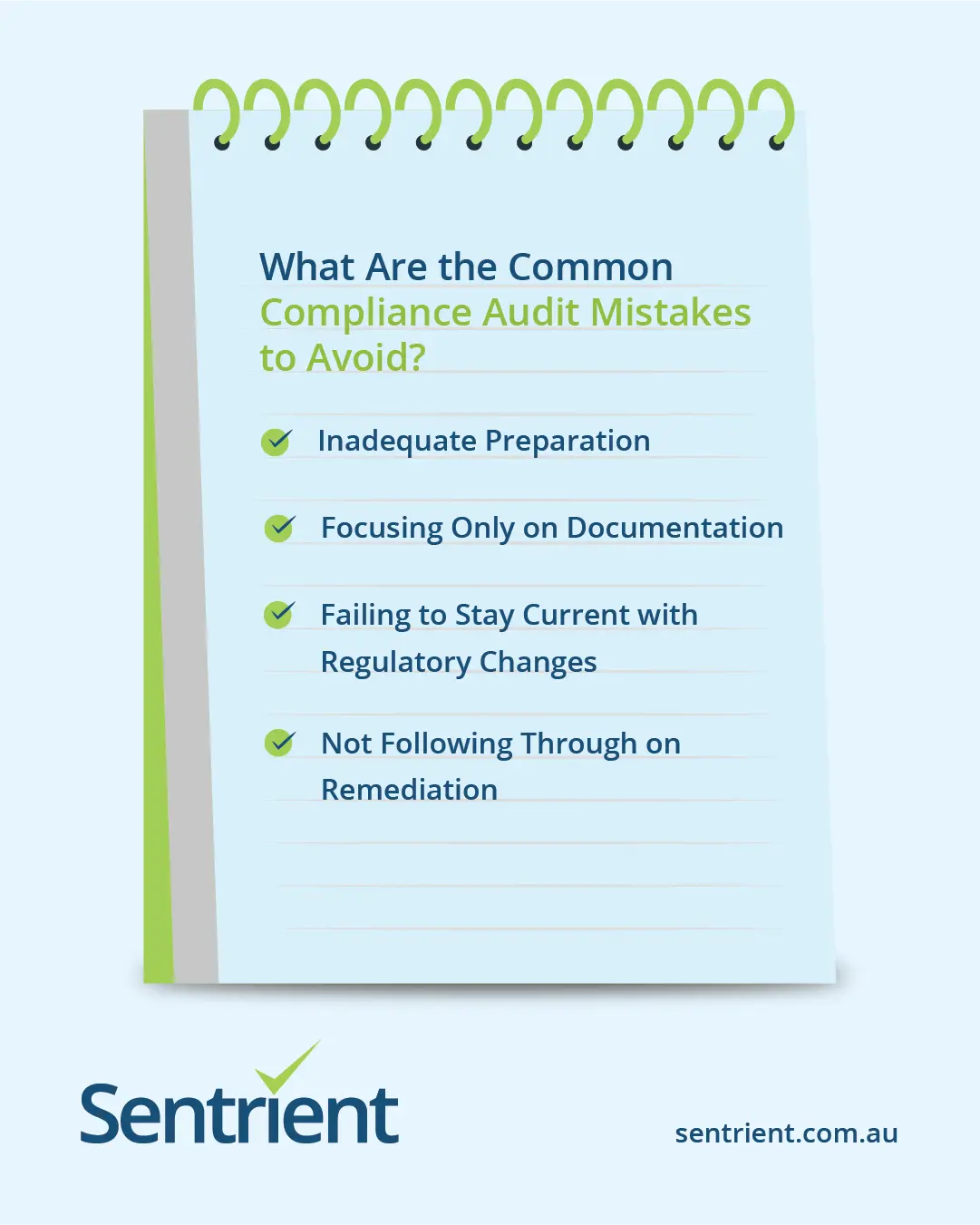

What Are the Common Compliance Audit Mistakes to Avoid?

1. Inadequate Preparation

Many businesses underestimate the time and resources required for a thorough compliance audit. This often leads to rushed assessments and overlooked compliance issues.

Allocate sufficient time for planning, document gathering, and analysis. A well-prepared audit yields more reliable results and actionable insights.

2. Focusing Only on Documentation

While documentation review is essential, compliance audits should also include workplace observations and employee interviews to verify that documented policies are followed in practice.

Incorporate different assessment methods to gain a comprehensive understanding of your business’s actual compliance status, not just its documented procedures.

3. Failing to Stay Current with Regulatory Changes

Always use the most current regulatory standards as your benchmark and consider subscribing to updates from relevant Australian regulatory bodies such as the Fair Work Ombudsman, ASIC, and Safe Work Australia to stay informed of changes affecting your industry.

4. Not Following Through on Remediation

Identifying compliance gaps is only valuable if followed by effective remediation. Many businesses fail to implement the corrective actions identified during audits.

Establish a formal follow-up process to track the progress of remediation activities and verify their effectiveness. This closes the loop on the audit process.

How Sentrient Helps Australian Businesses Master Compliance

Sentrient’s comprehensive compliance management system offers a purpose-built solution for Australian businesses looking to streamline every aspect of their compliance program. Our all-in-one platform integrates policy management, compliance training, and reporting capabilities specifically designed for Australian regulatory requirements.

Key benefits of the Sentrient compliance platform include:

- Legally-reviewed policies and procedures tailored to Australian legislation

- Interactive compliance training courses covering essential workplace obligations

- Automated compliance tracking with customisable dashboards and alerts

- Centralised document management for audit-ready record keeping

- Regular updates that reflect changes to Australian regulations

Our cloud-based solution eliminates compliance complexity by providing everything you need in one secure platform, accessible from anywhere your team works.

Conclusion

A systematic approach to compliance audits is essential for Australian businesses navigating the complex regulatory landscape. Regular, thorough audits help identify risks, protect your business from penalties, and maintain your reputation.

Investing in proper compliance management tools and processes ultimately saves resources by preventing costly non-compliance issues. Consider how much time and money your organisation would save by centralising your compliance activities on a purpose-built platform like Sentrient.

Ready to transform your compliance management approach?

Book a free demonstration of Sentrient’s compliance management solution today and discover how our Australian-developed platform can help your business stay ahead of regulatory requirements while reducing administrative burden.

FAQs

1. How often should Australian businesses conduct compliance audits?

Most businesses should conduct comprehensive compliance audits annually. However, high-risk industries or those subject to frequent regulatory changes may benefit from bi-annual reviews. Additionally, specific compliance areas might require more frequent monitoring.

2. Can small businesses benefit from formal compliance audits?

Absolutely. While the scale might differ, small businesses face many of the same regulatory requirements as larger organisations. Tailored compliance audits help small businesses identify risks efficiently and demonstrate due diligence in meeting their obligations under Australian law.

3. What’s the difference between internal and external compliance audits?

Internal audits are conducted by your own staff and provide ongoing monitoring of compliance status. External audits, performed by independent specialists, offer unbiased assessments and specialised expertise. Most businesses benefit from using both approaches.

4. How long does a typical compliance audit take?

The duration varies based on your business size, industry, and audit scope. A comprehensive audit for a medium-sized Australian business typically takes 2–4 weeks, including preparation, execution, analysis, and report development.